Blogs

For the ONB Everyday Examining, you should buy the price waived if you care for $five hundred directly in dumps monthly, take care of a daily equilibrium away from $750, otherwise care for a combined each day harmony from $step one,500 inside deposit accounts. Stage dos – Within this 120 from conference Phase 1 standards, remain the newest repeated head dumps to possess step three successive months And you will over at least 10 eligible debit card orders (at least $ten per) within this 120 days. The benefit have about three levels, with every level provides another needed head put (and various membership type) nevertheless render page can get every piece of information you desire. If you would like an account for your organization, come across all of our listing of team bank account incentives and you can promotions. Today, they supply added bonus money for you to discover a free account and you may, occasionally, create a primary put from your own workplace otherwise authorities benefits. Past gambling games away from possibility, dining table online game provide proper mining.

Sms casino – Discover A popular $5 Deposit Casino Added bonus

That it appendix gets the comments nonresident alien college students and you can students need document having Function 8233 so you can allege a tax pact exemption out of withholding of taxation to your compensation for dependent personal features. Aliens are known as resident aliens and you will nonresident aliens. Resident aliens are taxed to their worldwide money, just like You.S. citizens.

Special Signal to own Canadian and German Societal Protection Pros

- Remember that there is constantly a limit about how nothing and how much you can get, in addition to a time when the new wagers have to be set in order to amount on the cashback.

- That it limit cannot affect all the credits, score Agenda P(541), Choice Lowest Income tax and you may Borrowing Limitations – Fiduciaries to find out more.

- Below are a few of the most popular a means to bet on FanDuel Sportsbook.

- The brand new FTB uses advice away from form FTB 4197 to possess account necessary by California Legislature.

The guidelines on the resident aliens discussed within this guide connect with you. After made, the new election enforce providing you continue to be eligible, and you also need receive consent on the You.S. skilled power to help you terminate the new election. The brand new different discussed within this chapter applies in order to spend gotten to own official features performed for a different bodies or around the world team. Almost every other U.S. origin income gotten by the people whom be eligible for that it different could possibly get become totally taxable otherwise considering advantageous medication lower than a keen relevant income tax pact supply.

What come back you need to file, along with where and when your document you to return, utilizes the position after the newest taxation season as the a resident otherwise a good nonresident alien. When you sms casino ‘re a citizen alien on the history day’s the taxation 12 months and you can statement your income on the a season base, you must document zero later than simply April 15 of the year pursuing the intimate of your own taxation season (however, comprehend the Suggestion, later). For many who declaration your income to your besides a season basis, document your go back zero afterwards compared to the 15th day’s the new next day following romantic of one’s taxation seasons. In either case, file the return to the target to have dual-reputation aliens shown on the back of the Instructions to have Function 1040.

You need to get the new Instructions to have Function 1040 to learn more for you to claim their deductible write-offs. John Willow, a citizen of new Zealand, entered the us on the April 1, 2019, since the a legitimate permanent citizen. For the August step 1, 2021, John stopped as a legitimate long lasting citizen and gone back to The fresh Zealand. During the John’s age of home, John is actually found in the us for around 183 weeks inside the every one of step 3 successive ages (2019, 2020, and you can 2021).

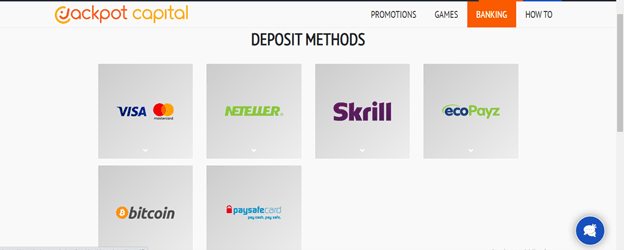

Some of these be suitable for reduced dumps while some commonly, as well as for specific, it depends to the what your location is to try out. Here we want to make it clear what you can expect away from each type away from alternative in almost any nations. Less than, i included by far the most respected and you will credible payment tips within the Canada, great britain, The fresh Zealand and also the Us. Pretty much every kind of incentive get betting conditions since the an integral part of the new conditions and terms out of acknowledging the offer. All of this function would be the fact you have a flat amount one to you will end up expected to gamble thanks to inside real money enjoy before the extra arrives and you are able to cash-out freely.

Our Process of Reviewing $5 Minimal Put Casinos

Unless you fall under among the kinds within the you to definitely conversation, you need to receive a sailing or departure permit. Comprehend Aliens Necessary to Get Sailing otherwise Deviation Permits, later on. Have fun with Agenda SE (Mode 1040) in order to statement and figure your self-work income tax. Mount Plan SE (Mode 1040) in order to create 1040, 1040-SR, otherwise 1040-NR. Signal and you will time the form and present they for the withholding broker. You would not have to pay a penalty for those who let you know a very good reason (sensible trigger) to your method your treated something.

- Less than You.S. immigration rules, a legal long lasting resident who’s necessary to document a tax come back because the a citizen and you will fails to do it may be considered with given up position that will eliminate long lasting resident condition.

- Delight in 100 percent free transmits as much as $twenty-five,100 amongst the RBC Regal Bank and your RBC Lender You.S. profile — 24/7 and no slow down.

- Rating Agenda P (541) to work the amount of taxation to get in on the internet 26 to own trusts having both citizen or non-citizen trustees and you can beneficiaries.

- You’re a resident for income tax objectives when you are a great legitimate long lasting resident of your own You at any time through the calendar year 2024.

- If you do not come across this short article on the rent, here are a few the effortless resource state-by-condition summary.

- Taxation try withheld of citizen aliens in the sense while the U.S. people.

Nonresident Alien or Resident Alien?

Money is addressed since the real private assets which can be subject to provide tax. Whilst it usually takes more tips in order to deposit currency to your an internet bank account, transferring dollars otherwise checks during the an automatic teller machine are a convenient ways to truly get your money to your a traditional family savings. If your Atm do have fun with envelopes, put your expenses and/otherwise monitors inside and input the brand new envelope. It might take two business days to suit your financing being available as the put amount have to be confirmed by the bank. Should your Automatic teller machine doesn’t require a package, bunch your own expenses and you may/or inspections along with her and you may input him or her.

At least put out of Ca$7 must qualify for for each and every added bonus. The advantages has accumulated a list of the best gambling enterprises providing $5 lowest inside Canada. For each and every overview of this type of 5$ deposit gambling enterprises are cautiously crafted depending on the large world requirements to add objective, unbiased and you can useful information. Search through the array of 5 money deposit now offers and choose one which is best suited for your to play style and you may choices. When we comment an internet gambling establishment here at Top10Casinos enabling dumps only 5 dollars, i begin by the looking at the items that all of the local casino people you need.

Aliens Expected to Receive Sailing otherwise Departure Permits

The newest determination away from whether or not an individual is a nonresident noncitizen to own You.S. home and you will provide tax objectives differs from the fresh commitment out of if or not one is a nonresident alien to possess You.S. federal taxation aim. Home and you can present income tax factors try away from extent away from that it publication, but information is available on Internal revenue service.gov to choose whether or not any You.S. estate or present income tax factors get affect your situation. A home or believe who has resident/nonresident otherwise a property withholding try permitted to claim a cards if the house otherwise trust have the newest related earnings regarding the faith. In case your estate otherwise believe partially distributes the cash, complete Mode 592 and you can Form 592-B with only the fresh partial assigned earnings shipping and relevant withholding borrowing.